According to a notification issued by the Federal Board of Revenue (FBR), following are the details of taxes applicable on vehicle tokens of each category (less than 850 cc to above 3000 cc). The category motor vehicle (section 231B) includes car, jeep van, sports utility vehicles, pick-up trunks for private use, caravan automobile, limousine, wagon, and any other automobile used for private purpose, excluding motorcycles and autorickshaws.

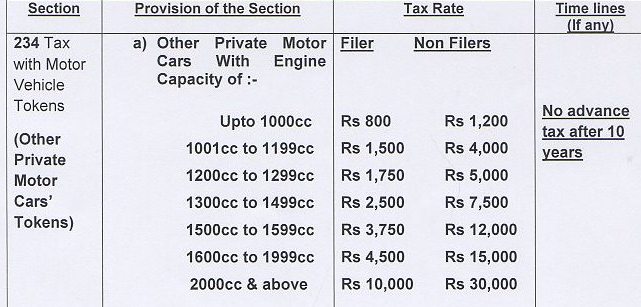

The detailed chart, published by the Federal Board of Revenue (FBR), is given below. For up-to-date tax rates, please visit the official website of FBR.

Home Disclaimer Advertise Contact Privacy Policy

Copyright (c) 2004-21 Paked.com. All rights reserved.